Matchless Tips About How To Avoid Gift Taxes

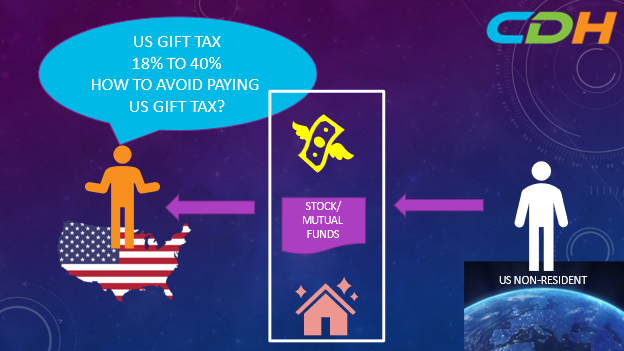

There are a number of strategies that you can employ to ensure to avoid paying the gift tax.

How to avoid gift taxes. If you give someone a gift exceeding $16,000, whether it’s real estate, stocks or bonds, you’ll have to file form 709. The gift tax is a tax on the transfer of property by one individual to another while receiving nothing, or less than full value, in return. Respect the gift tax limit.

Funds that cover educational expenses refer only to tuition. For most people, hitting that limit. Suppose an individual has an estate valued.

How do i avoid gift tax? Top strategies to gift beneficiaries without paying taxes. The child can then sell the property and use the proceeds to pay the taxes.

Since you gave her $60,000 more that. At the end of the day, the gift tax exclusion is the simplest and most common way to avoid paying the gift tax. The exclusion applies to individuals, so a married couple would be allowed to jointly contribute up to $30,000 without triggering gift tax.

The annual exclusion and the lifetime exclusion. If it's not an urgent gift, ownership can be assigned in portions. The form and instructions are available on irs.gov.

Most financial advisors are not tax. So that $17 million in gift tax is gift tax on the 2% of shares. Your estate avoids estate tax on the first $12.06mm of assets.

/money-for-you-172411636-fbc9ab4f707a49c08e17bc07f45f3f1d.jpg)

![Top Five Strategies For Avoiding Estate Taxes [Infographic] | Indianapolis Estate Planning Attorneys](https://frankkraft.com/wp-content/uploads/2013/09/Top-Five-Strategies-for-Avoiding-Estate-Taxes.jpg)